nevada estate and inheritance tax

Nevada State Personal Income Tax. Nevada has no state income tax inheritance tax or estate tax and fairly low property taxes.

Nothern Nevada Commercial Real Estate Nevada Tax Benefits

Property Tax Rate Range.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. Failure to Discover all Estate Assets and Liabilities of the Decedent. 1 online tax filing solution for self-employed. It later turned around and repealed the tax again retroactively to January 1 2013.

But the state makes up for this with a higher-than-average sales tax. This means Nevadas tax burden on residents and business is one of the lightest in the nation. Nevada is one of the seven states with no income tax so the income tax rates regardless of how much you make are 0 percent.

List every debt owed by the. Jun 19 2014 3 min read. Sales taxes are high but that is of little.

An estate attorney can assure compliance with the calculation and reporting of the Inheritance Taxes. Tennessee repealed its estate tax in. Americas 1 tax preparation provider.

Nevadas median property tax rate is 636 per 100000 of assessed home. By failing to identify all assets of the decedent. If TV ratings are any indication estate planning is not a popular entertainment topic.

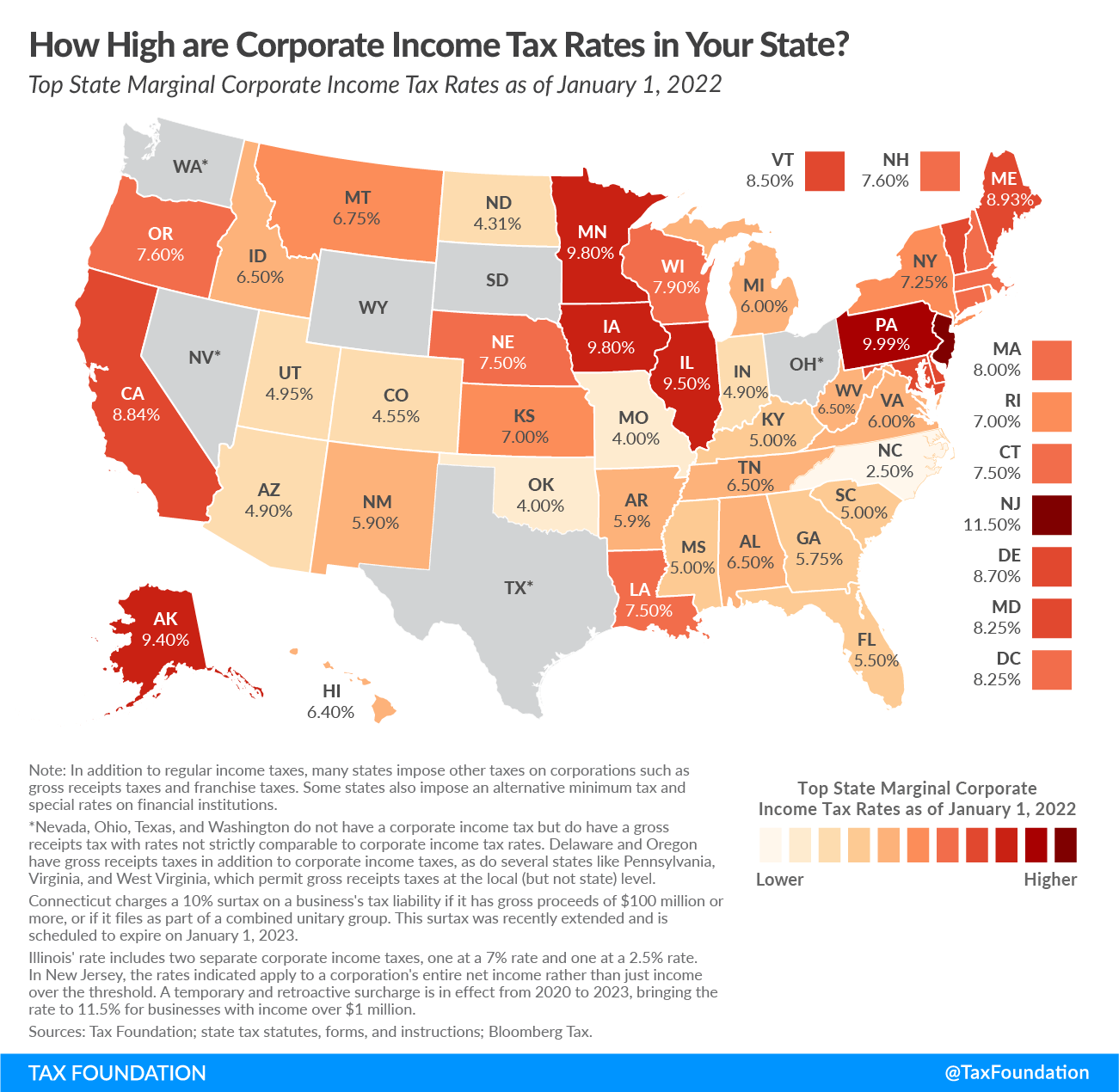

The personal representative must find and inventory all the assets of the estate and protect them. Nevada has No Inheritance Estate or Gift Taxes No corporate income tax No inventoryunitary or franchise tax. What State residents need to know about state capital gains taxes.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. In most cases will have some debt or be responsible for payments over certain actions ie. There is no state income tax.

Such liabilities and debts must still be paid by the Decedent. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. Estate taxes are taken out of the deceaseds estate immediately after their passing while inheritance taxes are imposed upon the deceaseds heirs after they have.

Inheritance and Estate Tax Rate Range. Preparation of and filing of the Inheritance Tax Return is complex so an estate attorneys assistance is invaluable. Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19.

25000 for other claimants. The personal representative may need to have an appraisal done and sell some assets if necessary to pay debts. The State of Nevada through GOED offers a variety of incentives to help qualifying companies make the decision to do business in the state including sales tax abatements on capital equipment purchases sales and use tax deferral on capital equipment purchases abatements on personal and modified business taxes real property tax abatements for recycling assistance.

Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law. The Internal Revenue Service IRS requires estates to exceed 114 million to file a. No Statute New Hampshire.

Lake Tahoe estate asks 100M in bid for Nevada record. Self-Employed defined as a return with a Schedule CC-EZ tax form. What You Need to Know About Getting a Tax Identification Number.

Localities can add as much as 56 to that but the average combined levy is 84 according to the Tax Foundation. Nevada Inheritance Tax and. Estate taxes and inheritance taxes are similar but there are some important differences to note.

What You Need to Know About Capital Gains Taxes. Calculate the Estates Value. Why is there such an aversion to it.

There are both federal estate taxes and state estate taxes. New Jersey phased out its estate tax in 2018. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. No personal income tax Property is assessed at 35 of appraised value. Nevada repealed its estate tax also called a pick-up tax on Jan.

Does Your State Collect an Inheritance Tax. Income Tax Range. Overall Rating for Taxes on Retirees.

The personal representative files tax returns and pays any taxes owed as well as any other debts. The Nevada State Legislature has passed a law.

Relocating To Nevada Nevada Tax Benefits Advantages Sierra Sir

Nevada Tax Advantages And Benefits Retirebetternow Com

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Is No 2 Among The Most Tax Friendly States Livewellvegas Com

Why You Need A Will Probate Divorce Lawyers Attorneys

Nevada Inheritance Laws What You Should Know

Nevada Trusts Safeguarding Personal Wealth Northern Trust

The 10 Best Places To Retire In Nevada Newhomesource Best Places To Retire Nevada Places

Nevada Property Tax Calculator Smartasset

Nevada Tax Advantages Luxury Real Estate Advisors

Historical Nevada Tax Policy Information Ballotpedia

Nevada Vs California Taxes Explained Retirebetternow Com